written by Matt Erchull, Senior Consultant – Government Solutions

******************************************************

In response to the COVID-19 pandemic, Federal agencies have provided funds to state and local governments through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law on March 27. The CARES Act established the Coronavirus Relief Fund (CRF) and appropriated a $150 billion to states, local governments, U.S. territories and Tribal governments.

Below we discuss how counties and cities that have received or are seeking CRF proceeds should plan for eligible use of this flexible source of federal assistance. We will focus on the areas of assessment, implementation and compliance to help best understand the eligible uses of CRF disbursements.

1. Assessment

Community Needs Assessment

Many counties and cities have additional municipal and government entities, non-profit organizations, healthcare providers, schools and businesses that are seeking access to proceeds from their CRF allocation. Oftentimes, these needs may be disproportionate to the entity size or service area. Prior to committing to a method of distribution for these entities, consider conducting a streamlined assessment of needs across service sectors to understand the impact COVID-19 had thus far within your community. Contemplate collecting information that can also inform entities’ capacity level, existing and projected funding needs, as well as associated grant/funding administration capabilities.

Witt O’Brien’s has developed a series of survey templates specifically catered to collect information from municipal entities, healthcare providers, social service providers, education providers and small businesses. These survey templates may be utilized to assist local government leaders make quick, informed decisions regarding their CRF proceeds, in a fair, reasoned and transparent manner.

Assessment of County Departmental Expenses

Concurrent to soliciting information from the broader community, counties and cities should work closely with their interdepartmental staff to establish knowledge of eligibility criteria, best practices for qualified expenses documentation and the development of a formal process for submitting expense payments or reimbursement requests for finance and Council/Commission approval.

Given many of your departments and agencies have already incurred costs, these processes should begin immediately. However, it should include an estimated assessment of future costs through December 30, 2020. Incurred costs along with future project costs requirements must be aggregated in order to generate an overarching analysis of the cost exposure. Further, outline the total estimated COVID-19-specific funding requirements from each department with consideration for timeliness, eligibility, cash flow and community benefits.

Counties and cities may learn that CRF is a more simplified, less burdensome funding stream than other Federal Assistance programs such as FEMA Public Assistance (PA). However, by aggregating costs and evaluating the eligibility conditions for each funding stream, you will be better positioned to work with your departments who manage FEMA, Housing and Urban Development (HUD) and Health and Human Services (HHS) grant programs as well as strategize opportunities to maximize funding sources and minimize cost recovery gaps.

Witt O’Brien’s experts have a comprehensive understanding of cost recovery/funding optimization framework and have developed eligibility assessment tools to guide local governments in identifying the best fit for each COVID-19-related expense.

Community Service/Public Health Initiatives

Beyond existing department and agency expenses, counties and cities may seek to implement several Community Impact and Public Health response initiatives through its Department of Health, Economic Development Agencies, Human Services or select trusted non-profit organizations providing essential public services to vulnerable populations.

In fact, many counties and cities may have already received requests from numerous entities seeking financial assistance for increased cost to deliver essential services and expand the scope and reach for essential services. Consider developing strategic planning committees in order to engage with these entities to determine eligibility and develop compliant, timely, cost-reasonable programs.

Program/Initiative Allocations

The aggregate of these concurrent assessment efforts will help inform a global allocation model that appropriately reserves funding for each programmatic area, while minimizing compliance risk.

2. Implementation

Application Process

To assist with efficient, expedient payment processing to both entities and organizations seeking assistance, counties and cities should develop a streamlined application for entities to submit for review.

The application should be easy to understand and will be used to document program expenses and include space to clearly link COVID-19 responses or impacts. Furthermore, the application must contain information that will allow county and city staff to understand the entities capacity, technical proficiency and other funding sources already received that can be utilized for the same purpose.

Witt O’Brien’s has developed a series of turn-key application models specifically catered to collect required information from municipal entities, healthcare providers, social service providers, education providers, small businesses and others. These products can be utilized to assist local government leaders review and process CRF payment or funding requests in a timely and compliant manner.

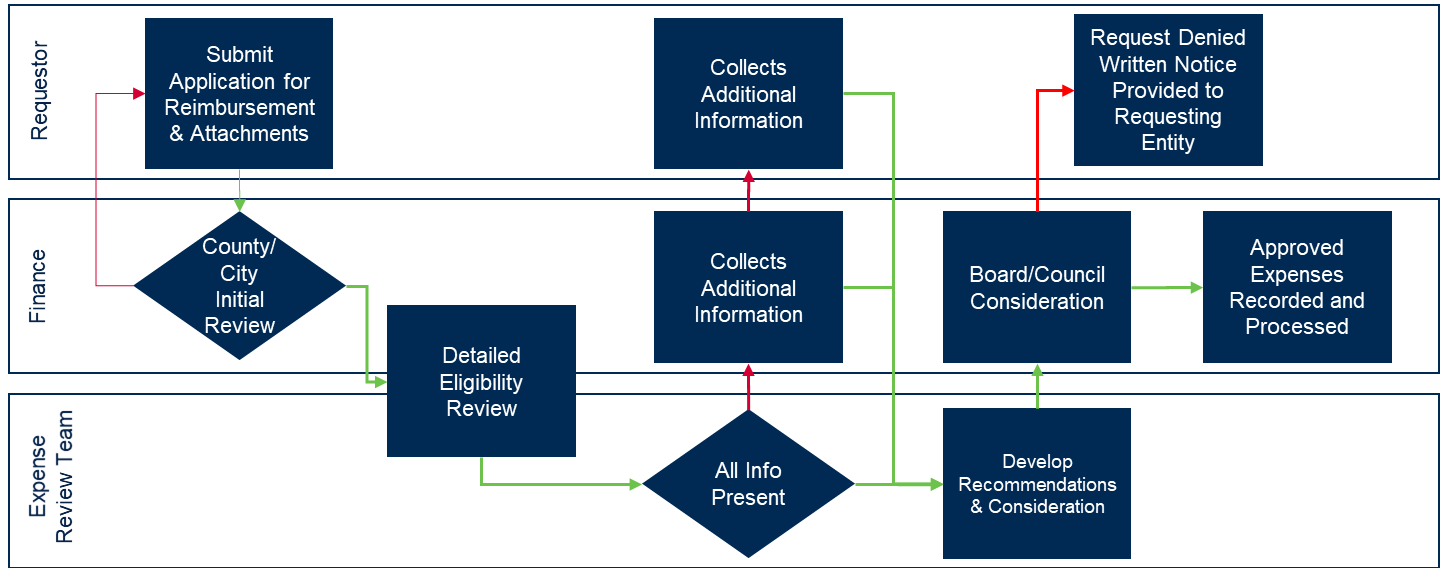

Application/Expense Review and Approval

Each application or subsequent expense reimbursement request should have a standardized format for review and approval. Several considerations include:

- Is the requesting entity in good standing?

- What is the necessity as it relates to COVID-19?

- What is the timeline for delivery/use of expense?

- Is there another source of funding available for this expense?

- How will the material/equipment/service be procured? Was it competitively procured?

- Does the contract or purchase order follow local procurement guidelines, and does it include necessary federal, state and local contract provisions?

- Is all information included to make a reasonable eligibility determination?

Application/expense requests should follow a compliant but minimally burdensome process for review, consideration and payment. A suggested process flow is detailed below.

3. Compliance

The CRF payment received by counties and cities are considered to be federal financial assistance subject to the Single Audit Act (31 U.S.C. §§ 7501-7507) and the related provisions of the Uniform Guidance, 2 C.F.R. § 200.303 regarding internal controls, §§ 200.330 through 200.332 regarding subrecipient monitoring and management, and subpart F regarding audit requirements. CRF recipients must implement policies and procedures outlining management of Fund disbursements to eligible parties. Further, to ensure compliance, each county/city should employ a series of financial management and federal assistance best practices.

Subrecipient Capacity Assessment, Technical Assistance and Monitoring

Each county/city should obtain enough information in the application process to make measured assessment of a potential subrecipient’s financial and administrative capacity to spend funds in an expedient and allowable manner. As stated previously in the implementation phase outline, each county/city should continuously evaluate an applicant’s standing and performance related to CRF disbursements. Each recipient should sign a certification, attestation or subrecipient agreement that outlines capacity, performance and reporting expectations.

To mitigate risk of fund mismanagement, counties and cities should provide technical assistance on as-needed basis for entities that may prove to be a compliance risk. Additionally, subrecipients are subject to periodic performance and compliance monitoring.

Witt O’Brien’s is currently working with numerous local government clients providing training and technical assistance to support vetting potential subrecipients, reviewing periodic reporting from subrecipients, and periodic monitoring on behalf of counties and cities. We have a built a team of qualified experts with pertinent expertise in working with subrecipients across anticipated service sectors impacted by COVID-19.

Expense Eligibility Review

Because federal guidance pertaining to the use of CRF is limited and remains subject to interpretation, counties and cities must develop a process for evaluating expenditure requests and eligibility considerations. Include an Eligibility Review Memo for large or unconventional expenditures to document cost reasonableness, timeliness and necessity as it relates to COVID-19, and any compliance risk considerations and associated mitigation strategies.

Noting local impacts or COVID-19 characteristics at the time expenses were incurred will help establish that the decision was reasonable, prudent and proportionate based upon the information available at the time. This will be key when demonstrating why costs may have been elevated, why you acted using emergency procurement provisions, or why the use of CRF funds was the most suitable option.

Witt O’Brien’s is working with numerous local government clients providing eligibility review services for high risk or large cost expense items. Our team of subject matter experts has developed a comprehensive library of Eligibility Review Memos covering PPE, public and private facility retrofits, vehicle acquisitions, payroll expenses, public health initiatives and contact tracing and serological testing. This enables us to efficiently support county and city clients seeking to make timely and informed decisions regarding expenses with the appropriate compliance considerations established before an expense is incurred.

Grant Management Solution (GMS)

Utilizing a purpose-built grant management solution specifically catered to CARES Act funding will expedite auditing of CRF fund proceeds. Counties and cities may consider utilizing a GMS when administering CRF and other federal assistance programs.

Witt O’Brien’s has developed such a solution specifically configured to enable county or city staff to receive funding requests in a standardized format, ensure programmatic or subrecipient budgets are not exceeded and provide for a centralized repository for CRF expenditures in order to simplify the auditing process.

Coronavirus Relief Fund Administration

Given administrating federal assistance programs is often burdensome and can produce additional layers of risk, you may consider soliciting a qualified emergency management and grant administration firm such as Witt O’Brien’s, which is also an eligible use of your CRF funds.

Since the onset of the public health emergency and subsequent emergency declarations, Witt O’Brien’s has been at the forefront of building strategies that are replicable and scalable across our broad portfolio of local government clients. Because we are simultaneously supporting similar local government clients around the country, we can provide useful insights into strategies, concepts or implementation plans being utilized elsewhere that may fit the needs of your community.

******************************************************

We look forward to the opportunity to guide local government clients. Please contact us at covidhelp@wittobriens.com for information or to schedule an introductory call or meeting to discuss how we can help you leverage federal assistance to meet the many challenges of the COVID-19 public health crisis.

About Matthew Erchull:

Matt is a nationally recognized subject matter expert in a broad range of federally funded grant programs designed to assist disaster and crisis impacted communities. His vast federal crosscutting knowledge base enables him to deliver multi-jointed funding strategies to key stakeholders responsible for responding to and recovery from major emergency and disaster events. Matthew previously served as the Director of Research & Strategic Analysis for New York State’s Superstorm Sandy recovery effort and has well over a decade of experience supporting states, local governments and private non-profit organizations across the US. Since the onset of the COVID-19 public health crisis, Matthew and his purpose-built team have been developing and delivering solutions for utilizing Coronavirus Relief Funds, supporting States, counties and cities throughout the country.